newsfirst.lk

46%

968

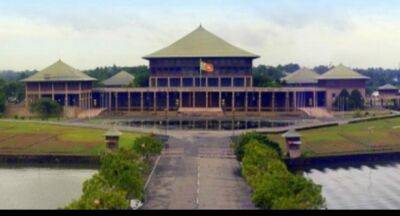

National Council appoints sub-committees on economy

COLOMBO (News 1st) – The 'National Council' decided to form two sub-committees related to national policies and economic stabilization at the inaugural meeting held with the participation of the ruling party and the opposition.The purpose of setting up the Sub-Committee on National Policy is to set the common priorities of Parliament to guide the formulation of medium and long-term national policies. Also, the purpose of establishing the Sub-Committee on Economic Stabilization is to reach agreement on the short- and medium-term programs related to economic stabilization.These decisions were taken at the inaugural meeting of the 'National Council' held at the Parliament complex on Thursday (29) under the chairmanship of Speaker Mahinda Yapa Abeywardena. Prime Minister Dinesh Gunawardena, Leader of the House Minister Susil Premajayantha, Chief Government Whip Minister Prasanna Ranatunga, Chief Opposition Whip Lakshman Kiriella, Minister Tiran Alas were presented for the meeting.In addition, Members of Parliament Asanka Navaratne, Rauf Hakeem, Rishad Bathiudeen, Mano Ganesan, Palani Digambaram, Jeevan Thondaman, Sisira Jayakodi, Namal Rajapaksa, Johnston Fernando, Sagara Kariyawasam, Ali Sabri Rahim, Rohitha Abeygunawardena, Vajira Abeywardena, Sivaneshthurai Chandrakanthan, Champika Ranawaka and several members of Parliament were present.Secretary General of Parliament Mr. Dhammika Dasanayake was also present at this meeting.Prime Minister Hon.