globalnews.ca

54%

857

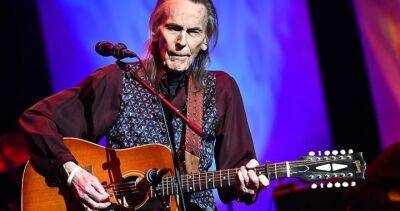

Gordon Lightfoot, legendary Canadian singer-songwriter, dead at 84

Gordon Lightfoot, often called Canada’s greatest songwriter and known worldwide as one of the founding fathers of folk-rock, has died at age 84, a representative for his family said Monday.The musician recently cancelled all of his 2023 tour dates, citing “health-related issues.” His representatives did not elaborate further at the time.An iconic figure in the ‘60s and ‘70s, Lightfoot wrote many songs that transcended borders and music tastes, including The Wreck of Edmund Fitzgerald, Ribbon of Darkness and If You Could Read My Mind, among many, many others.Legendary musicians like Elvis Presley, Johnny Cash, Hank Williams Jr., Bob Dylan and Barbra Streisand — to name just a few — have recorded Lightfoot’s songs to great success, and he was widely respected in the music industry.Robbie Robertson of The Band called Lightfoot a “national treasure,” and Dylan himself said he wished Lightfoot songs could “last forever.”Born Gordon Meredith Lightfoot, Jr. in Orillia, Ont., on Nov.